LCX has joined forces with Blockpit to provide comprehensive insights into your portfolio and explore potential tax optimization opportunities. Blockpit is a solution for crypto tax filing and portfolio management in Europe. Start now to receive a 25% discount on your first Blockpit license and enter a 3,000$ LCX token raffle by registering with Blockpit in April.

Navigating the complexities of tax season can be a daunting task. The time-consuming nature of the process can lead to frustration and confusion, especially when keeping track of taxable events under different circumstances amidst frequently changing legal frameworks. If you’re actively trading and investing in cryptocurrencies like Bitcoin, Ethereum, Dogecoin, or LCX products such as “Earn”, the complexity can reach a whole new level.

In collaboration with Blockpit, LCX aims to ease the burden often associated with tax season. Our partnership is designed to provide you with the necessary tools and insights, making the process smoother and more manageable. Whether you’re a crypto enthusiast or an investor in LCX products, our joint effort with Blockpit is geared toward simplifying your tax-related experiences.

Count on LCX and Blockpit to streamline your tax journey and ensure that you can focus on what matters most – your investments.

Why Crypto Taxes Are Important?

Crypto taxes are crucial for several reasons. Firstly, compliance with tax regulations ensures legal standing for crypto users and prevents potential legal issues. Secondly, accurate reporting contributes to a transparent financial system, fostering trust among investors and regulators. Thirdly, proper taxation helps governments collect revenue for public services, infrastructure, and societal development. Additionally, it aids in combating financial crimes such as money laundering and fraud by creating a traceable record of transactions. Lastly, understanding and fulfilling tax obligations enhance overall financial literacy within the crypto community, promoting responsible and informed participation in the evolving landscape of digital assets.

How to Start Your Blockpit Journey

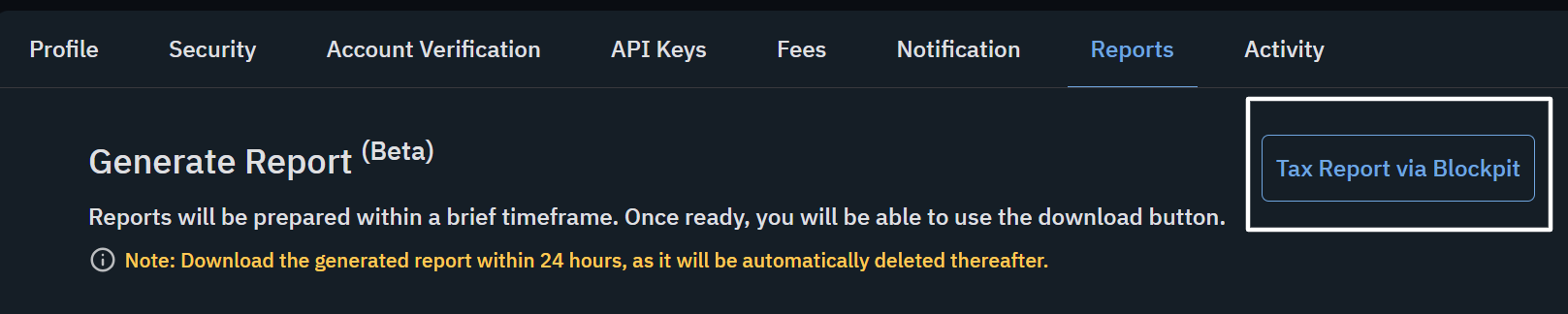

Using Blockpit to effortlessly monitor transactions and generate tax reports with just a few clicks. Begin by signing up on Blockpit via LCX, then seamlessly sync your trading account with Blockpit through the API import function.

Blockpit automatically imports and categorizes your transaction data in compliance with legal standards, providing you with a real-time overview of your tax liabilities. When ready, effortlessly generate a comprehensive tax report, ready to be filed alongside your other essential tax documents. Simplify your tax management process with Blockpit’s user-friendly interface and seamless integration with your trading account on LCX. With comprehensive support for the US, UK, France, Spain, Germany, Austria, Switzerland, Belgium, and the Netherlands, Blockpit simplifies your tax filing process. For more country-specific tax information, visit Blockpits tax guides.

Blockpit offers unparalleled integration capabilities

With over 250,000 digital assets and 2,700 integrations, including 150+ exchanges, 160+ blockchains, 70+ wallet services, and 2,300+ dApps, Blockpit got your crypto transactions covered. Benefit from 10+ years of historical price data and their collaboration with CPAs and regulatory bodies for maximum compliance. For more details on their integrations, visit https://www.blockpit.io/integrations.

Special Discount: LCX users enjoy a 25% discount on their first tax report. Sign up now and start saving: https://www.blockpit.io/lp/LCX. Register your account until the end of April to enter the 3,000$ LCX token raffle