Demystifying the Impact of Bitcoin ETF Launch on BTC Price

A few months ago, Bitcoin prices were stable in the $30K to $40K range. Then, near the end of the year, prices appeared to take off, putting the entire market into a bull run.

After attending its all-time high of around $65k, bitcoin price started plummeting and reached below $30,000 in July. Prices have risen dramatically, reaching $40K, $47k and then settling around $50K for a while. Here’s where the ETF effect comes into play, driving up the prices of BTC, ETH, and other altcoins even more, with many reaching new all-time highs.

With the positive stimulus of Bitcoin ETF, prices have gone up this month across the board. Bitcoin breaking its previous all-time high reached $66,999, with Ethereum also breaking above the $4000 mark after a few months.

Bitcoin ETF Launch

The New York Stock Exchange has officially launched the first Bitcoin ETF in the United States on Oct 19, 2021. The first day’s trading volume was 24.42 million shares, worth about 1 billion dollars, making it the most popular financial market investment of the day and one of the most widely held ETFs.

ProShares, an American asset management firm, has launched a “Bitcoin Strategy ETF.” The United States SEC recently cleared it to go public, and it became the first ETF to be accepted in the eight-year history of Bitcoin ETF applications in the United States. This is seen as a watershed moment in the history of cryptocurrencies, indicating that Bitcoin has entered the capital-rich realm of the mainstream U.S. market.

According to the ProShares release note, the ProShares Bitcoin Strategy ETF will trade under the ticker symbol “BITO” on the New York Stock Exchange. BITO will be betting on the future price trend of Bitcoin rather than directly investing in Bitcoin spot. BITO mainly invests in compliant futures contracts traded on the Chicago Mercantile Exchange, with an annual management fee rate of 0.95%. As of October 19, it has held contract positions worth more than $570 million.

The ETF Effect

On October 20, the price of Bitcoin rocketed to a new high after almost 189 days, following the successful launch of the first Bitcoin-focused exchange-traded fund (ETF) in the United States.

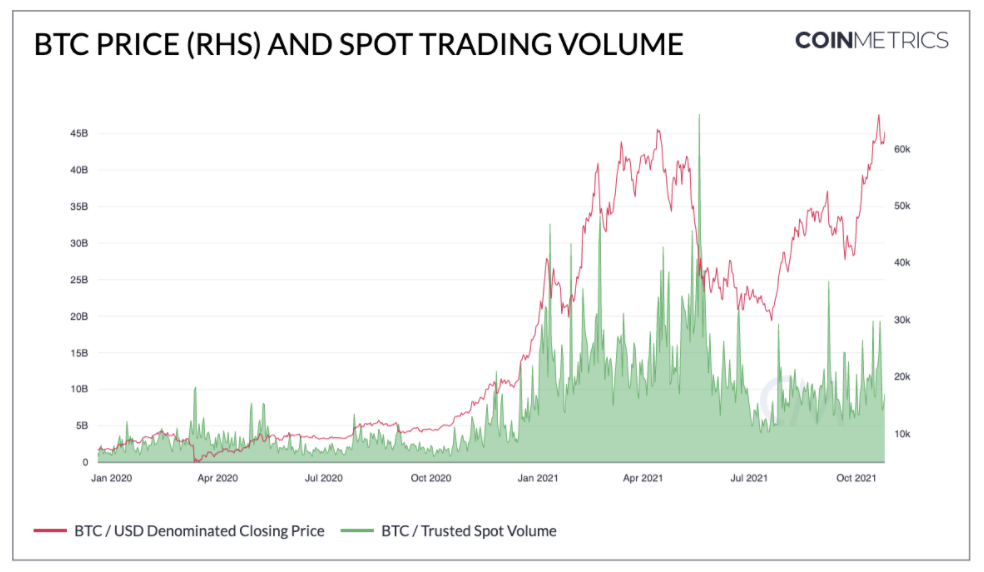

According to the report by CoinMetrics, Analysing the BTC SPOT trading volume, it is clear that the current rise in bitcoin price is not backed by daily spot trading volume like the previous bitcoin price rally in April 2021. The data further highlights that BTC spot volume across trusted exchanges averaged $11.5 billion per day in October, with a high of $19.4 billion on October 15th. This is significantly lower than earlier this year when spot trading volume regularly exceeded $20 billion. If the remaining seven days of October follow the monthly average, the total BTC spot volume in October will be around $350 billion. This would be higher than the totals for July, August, and September but lower than the total monthly volume recorded in each month from January to May of this year when volume topped $400 billion in each of the first five months.

The Short and Mid Term Analysis

In the short term, the outlook for bitcoin looks positive. With the launch of the first Bitcoin ETF, the short-term outlook for bitcoin seems bullish. People believe the launch of Bitcoin ETF is a big step for Bitcoin as it is still a niche and alternative investment product for investors. The launch of the ETF is undoubtedly a great benefit to the cryptocurrency market as this reflects the maturity and exponential growth of the bitcoin market.

While in the midterm, the outlook for bitcoin seems neutral. Looking at the next five or six years in the mid-term, Bitcoin ETF may not hold significant importance in affecting the market price of bitcoin.