Cryptocurrency has garnered substantial attention and continues to garner growing interest, with its potential yet to be fully realized. A critical component of trading cryptocurrencies is a thorough understanding of technical trade indicators, which provide traders with valuable insights to inform their buying and selling decisions.

Technical trade indicators are mathematical calculations that leverage historical price and volume data to forecast future price trends of cryptocurrencies. These metrics serve as a crucial tool in the arsenal of cryptocurrency traders, offering a systematic approach to analyzing market behavior and informing strategic decision-making.

What Is a Stochastic Oscillator?

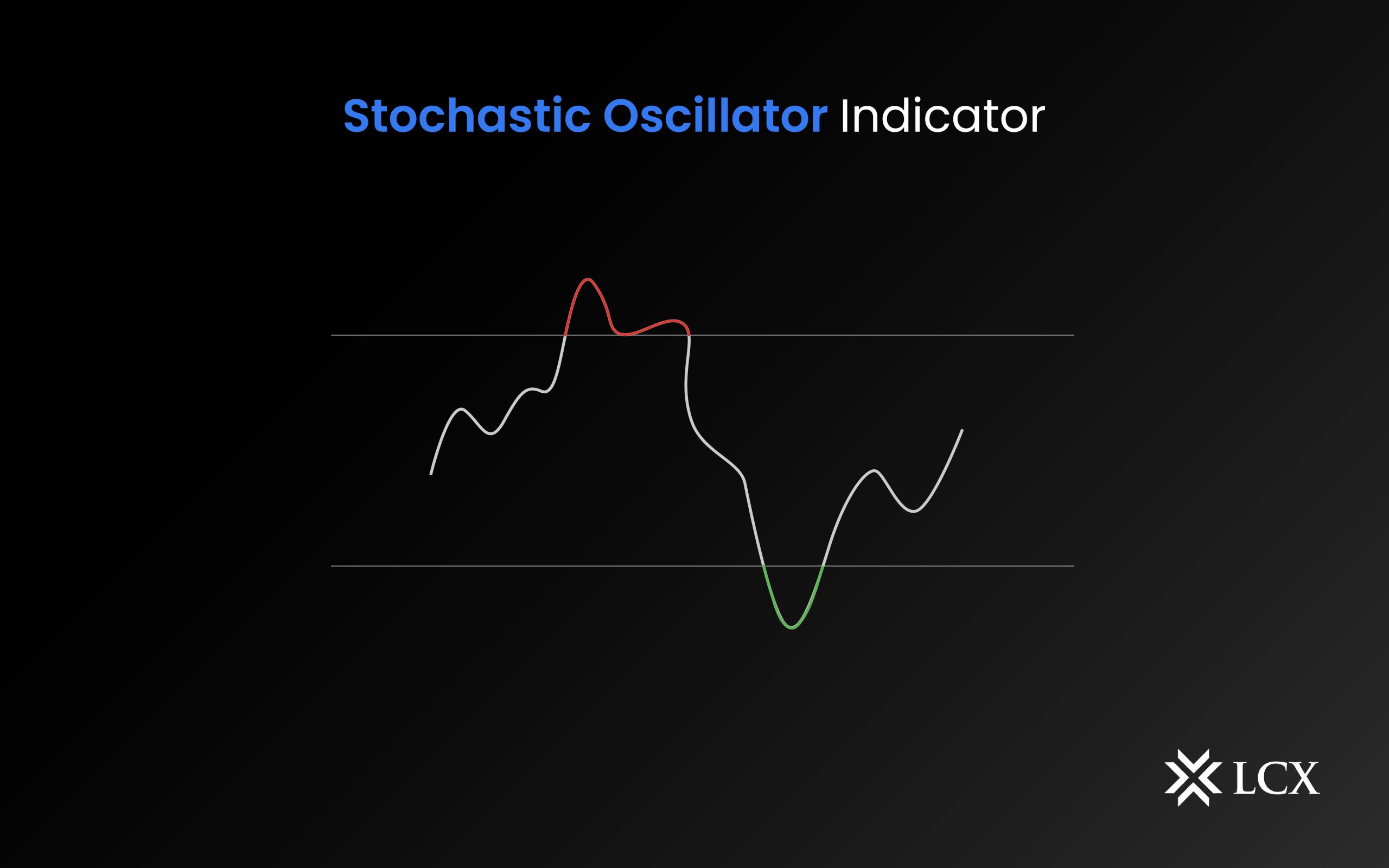

The stochastic oscillator is a popular technical indicator that can help determine the best time to enter and exit a trade by identifying overbought and oversold cryptocurrencies. Within the crypto world, the stochastic oscillator is one of the most popular and widely used technical indicators. The range value exists between 0 and 100.

The indicator was developed by George Lane in the 1950s. He designed the indicator to calculate the location of the closing price of an asset compared to the low and high ranges of the same asset over a period of time.

How Is a Stochastic Oscillator Calculated?

The indicator is calculated using the following formula:

%K=100 * (Current Close-Lowest Low)/ (Highest High-Lowest Low)

%D= 3-day SMA of %K

SMA stands for Simple Moving Average, Lowest Low = lowest low for the look-back period, Highest High = highest high for the look-back period, and %K is multiplied by 100 to move the decimal point to two places.

The %K value is calculated on a scale from 0 to 100, with readings above 80 indicating an overbought asset and readings below 20 indicating an oversold market. These levels serve as potential entry and exit points for traders.

Why Do Crypto Traders Use the Stochastic Oscillator?

Cryptocurrency traders can use the stochastic oscillator just like they do when trading traditional assets. Due to the extremely volatile nature of cryptocurrencies, this indicator can provide clarity on market conditions so that traders can optimize their trading strategies. The LCX Exchange offers integrated TradingView charts and allows traders to use indicators like stochastic oscillators and more while trading to let them tap into their full potential at trading.

A stochastic oscillator is a favored trading indicator as it aids traders in identifying trend changes more accurately. For example, if the oscillator is trending upwards, it may indicate that the security’s price is also trending upwards, and vice versa. This can help traders make more informed decisions about when to buy and sell their assets. This can help traders make more informed decisions about when to buy and sell their assets. In addition to identifying trend changes, the stochastic oscillator can also help traders spot potential divergences between the cryptocurrency’s price and the oscillator. For example, if the cryptocurrency’s price is trending upwards but the oscillator is trending downwards, it may indicate that the security’s price is likely to correct itself in the near future.

Conclusion

The utilization of a stochastic oscillator holds immense significance in the realm of cryptocurrency trading, providing traders with crucial information regarding entry and exit points, trend shifts, and divergence detection. Incorporating this indicator into one’s trading strategy has the potential to enhance the likelihood of success in the highly unpredictable cryptocurrency market. However, to achieve optimal results, it is essential to integrate the stochastic oscillator with other technical analysis techniques such as moving averages and support and resistance levels. This comprehensive approach to market analysis equips traders with a multifaceted understanding, enabling them to make informed and effective trading decisions.