Our LCX blockchain ecosystem would not be complete without security tokens, which is why we are planning to establish our own institutional-grade security token exchange. On this page, we explore what securities, tokenized securities and security token exchanges are and how LCX is planning to become the leading security token exchange.

What are Securities?

Securities are financial instruments that hold a monetary value based on the asset it relates to. Securities include, but are not limited to:

Stocks: Represent part ownership of a public company

Options: Representation of rights to ownership

Bonds: Debt financing, issued by organizations such as governments, state and municipalities but also by private organizations

Exchange-Traded Funds (ETFs): represents a basket of assets

Real Estate Investment Trusts (REITs): represents a basket of real estate

Index funds

-

They expect the value of the security itself to appreciate, hence generating a financial profit once sold.

-

They are interested in the rights the security gives access to, such as dividend payouts, interest, appreciated sale at maturity (bonds) or voting rights.

The Advantages of Tokenizing Securities

Security tokens are highly similar to traditional securities, however, with one key difference, the tokenization of these assets. This is highly exciting because the technological upgrades made possible by blockchain technology can dramatically improve the dynamics of the traditional securities, bringing the rather outdated infrastructure this industry runs on to the next level. The potential benefits of tokenizing securities include:

Programmability of securities (automated dividend payouts, integrated voting protocols, regulatory compliances such as reporting, KYC and AML procedures)

Increased transferability of ownership

Interoperability of unrelated securities

24/7/365 security trading

Dramatic cost reductions because of the removal of most middleman

Fractionalization of securities and the assets they represent

Major boost of addressable (global) investor pool

Immutable transparency

During 2017, utility tokens and ICOs were the buzz words, however, security tokens present a much more tangible investment opportunity in this new and exciting space as they are asset-back. As we’re moving from utility tokens to security tokens, we are simultaneously shifting from ICOs to STOs, which is an acronym for Security Token Offering. For the launch of an STO, security token exchanges are an essential part.

Classification of Tokens

The Liechtenstein Blockchain Laws define three different tokens:

Utility tokens represent access to a company’s product or service, or better said, the products or services provided by a network. They are designed as (future) purchases, not as investments. A utility token is a native currency of a blockchain or a blockchain-based app (DAPP) and is implemented to create a unique token economy for the blockchain or dapp.

Payment tokens, or transactional cryptocurrencies, are blockchain-based, digital currencies created as an alternative to traditional currencies for financial transactions.

Security Tokens are highly similar to traditional securities, which include stocks, bonds and options, however with a strong technological upgrade, effectively giving them the potential to transform the financial industry. They have an income-generating component and potential rights to the security token holder, such as dividends, interest and voting rights. Because of the programmability of security tokens, they can alter the existing dynamics of securities significantly.

Issuing and Emission of Crypto Securities: Security Token Offerings (STO)

Considering the market’s inclination for high-quality, compliant cryptocurrencies, thereís a strong reason to believe that the STO model will have a longstanding significance on the blockchain ecosystem. In consideration the assets which are represented by the STOs already exist in the real world, they act as a bridge between legacy finance and the blockchain world. Below are seven reasons why STOs have the potential to change the dynamics of the crypto industry as a whole.

Programmable Ownership and Compliance

STOs are programmable by nature, which means compliance protocols can be embedded into the actual asset and amended over time. This also means there’s no limit to the types of rules and systems that a security token can bring to the table.

Reduction of corruption, fraud and money-laundry

The chances of corruption and manipulation will decrease drastically and maybe removed from the investment process as the number of middlemen will decrease remarkably.

Enhance the Crypto Ecosystem

Increased regulation and credibility will put an end to much of the odium encompassing cryptocurrencies among traditional investors. This could enhance the ecosystem with new market players and capital. Investors who are banking on greater institutional adoption should look beyond just bitcoin futures and custodial solutions and more towards STOs.

Bringing Credibility Back

Following the number of un-regulated Initial Coin Offerings (ICO), STOs that follow federal protocol are approved by the SEC should gain imperative credibility, taking much of the groan work out of assessing projects. This means investors can spend less time investigating project members’ LinkedIn profiles to prove they are legit and spend more time in calculating the merits of the actual business model.

Decentralized assets remain decentralized

As distinguished by the SEC, regulations influencing security token offerings have no significance on assets that are ‘sufficiently decentralized’ such as bitcoin and Ethereum. Decentralized currencies are here to stay, except now the negativity associated with cryptocurrency and digital assets will go away.

Actual Ownership of Underlying Assets

Though these so-called ìutility tokensî were designated to give investors future access to a product/service, a security token illustrates actual ownership of an underlying asset. If you invest in a real estate STO, your holdings portray actual shares in that tangible property rather than an IOU for a future date.

Increased Innovation

A regulated ecosystem for tokenization will open the door to greater acceptance and new innovations in the blockchain sphere. More innovative environment means more investment opportunities and wealth creation. This trend is already well commenced as startups and institutions continue to take advantage of decentralized ledgers.

What is a Security Token Exchange?

As traditional securities are bound for a serious technological upgrade, so is the infrastructure for the exchange of these financial assets. Securities in its current state can be bought and sold through:

Brokerage houses

Directly from the issuing company

Banks

Peer-to-peer

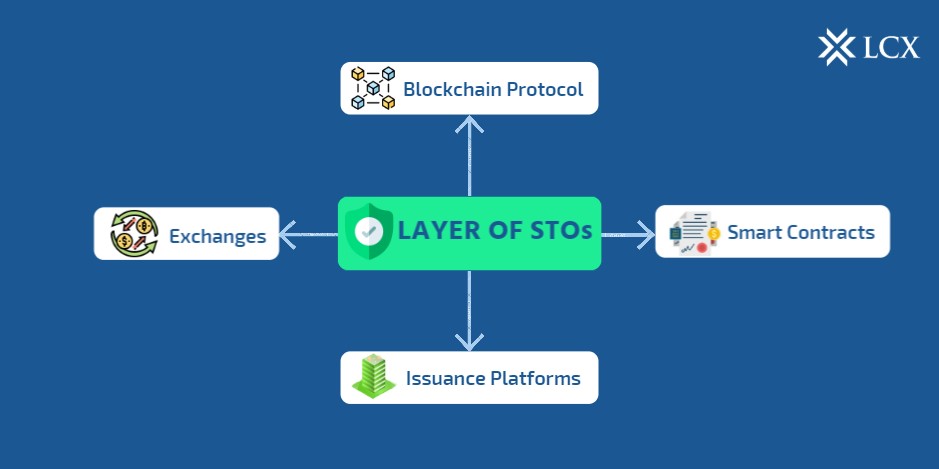

Security token exchanges are platforms that facilitate the buying and selling of security tokens for investors. This requires entirely new technological infrastructures compared to the traditional platforms, however, they are still bound the the same rules and regulations.

Exchanges for security tokens are therefore comparable to the traditional facilitators of security trading and most of the security tokens exchanges will be centralized companies, even though decentralized security token exchanges that leverage the inherent benefits of blockchain technology are to be expected in the coming years.

There are several limitations to the infrastructure design of traditional securities. Most brokerages, issuing companies, banks and peer-to-peer platforms are only allowed to operate in their regional jurisdiction and can not facilitate the trade of securities to investors outside of this. Moreover, most security services are only available to investors that meet specific, arbitrary, criteria, are only open during business hours and tend to focus on specific types of securities and their services are quite costly in terms of fees for using these middleman.

As security token exchanges are being build from the ground up, they can tackle these problems in their architecture. Even though security token exchanges are still bound by the jurisdiction they operate from, blockchain technology and tokens have a strong global appeal and with the proper regulatory frameworks, such exchanges can open up security investing for a much broader audience without closing times.

Moreover, because of the underlying blockchain infrastructure, the ownership of security tokens is embedded in the token itself, making the transferability of them secure and instant, something traditional security trading organizations can’t provide.

However, the most promising benefit of security tokens, the programmability of securities, trickles down to the operations of security token exchanges in the sense that a lot of services currently provided by middleman (underwriting, regulatory compliance, KYC and AML obligations, insurances and security) can be automated and facilitated through smart contracts and blockchain technology, making the exchanges vastly more efficient.

The Challenges for Security Token Exchanges

Even though security tokens and their related exchanges are very promising, there are several major hurdles that need to be overcome before they can reach the broader investor pool. Investors in traditional securities will demand the same levels of security, financial products and services, custodian services and support services as they are used to.

Additionally, the blockchain industry has been plagued by regulatory uncertainty, something that security token exchanges will have to work with as well. A major advantage security token exchanges have over cryptocurrency exchanges is that the regulatory framework for securities is robust and clear, making it much easier for these type of exchanges to be regulatory compliant.

As cryptocurrencies, in general, haven’t been building the most credible reputation over the past years, security tokens will have to provide institutional-grade services and levels of trust. This is of vital importance for any security token exchanges because the vast majority of capital invested in traditional securities comes from institutional investors. In order to reach these essential investors, a number of pain points that have thus far been sidelining institutional capital from investing in the new asset class of cryptocurrencies and tokens have to be resolved by security token exchanges to reach the critical mass required to assure liquidity and the long term survival of the exchange. We have identified 5 main pain points, and are building our security token exchange specifically with the solutions to these pain points in mind.