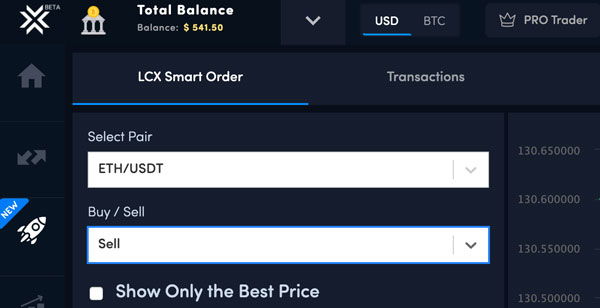

Liechtenstein Blockchain Innovator LCX announces the launch of LCX Smart Order. LCX Smart Order is an automated smart order routing system for cryptocurrency trading. Advanced algorithms compare prices across 10 crypto exchanges in real-time and execute orders at the best market price. The new smart order engine aims to simplify the digital asset management experience for crypto traders, family offices, hedge funds, and other asset managers.

The increased number of crypto exchanges has caused fragmentation of liquidity, as crypto assets are traded across multiple exchanges at different prices and in different amounts. LCX Smart Order is part of LCX’s high-performance, multi-asset trading system technology, LCX Terminal. LCX Smart Order provides ultra-low latency and high throughput with a full range of routing functionality, placing orders based on the best available option.

LCX Smart Order can be accessed via LCX’s Trading Terminal, which was launched in June 2019. LCX Terminal is a professional crypto trading platform to manage digital assets across multiple exchanges from one, fast and intuitive interface.

LCX Smart Order offers automated strategies for simultaneous and sequential routing allowing traders to access liquidity across multiple markets and leverage arbitrage opportunities.

Monty Metzger, CEO at LCX says, “LCX Smart Order is yet another step forward to simplify cryptocurrency trading. At LCX we follow a holistic business strategy to transform the speculative crypto market into a mature token economy.”

LCX Smart Order is initially available as part of LCX’s free plan.

Sign up now at https://terminal.lcx.com/

Risk Warning: Digital assets, such as Cryptocurrencies and Tokens, are subject to a number of risks, including price volatility. Transacting in digital assets could result in significant losses and may not be suitable for some consumers. Digital asset markets and exchanges are not regulated with the same controls or customer protections available with other forms of financial products and are subject to an evolving regulatory environment. Digital assets do not typically have legal tender status and are not covered by deposit protection insurance. The past performance of a digital asset is not a guide to future performance, nor is it a reliable indicator of future results or performance. Additional disclosures can be found at Terms of Service.