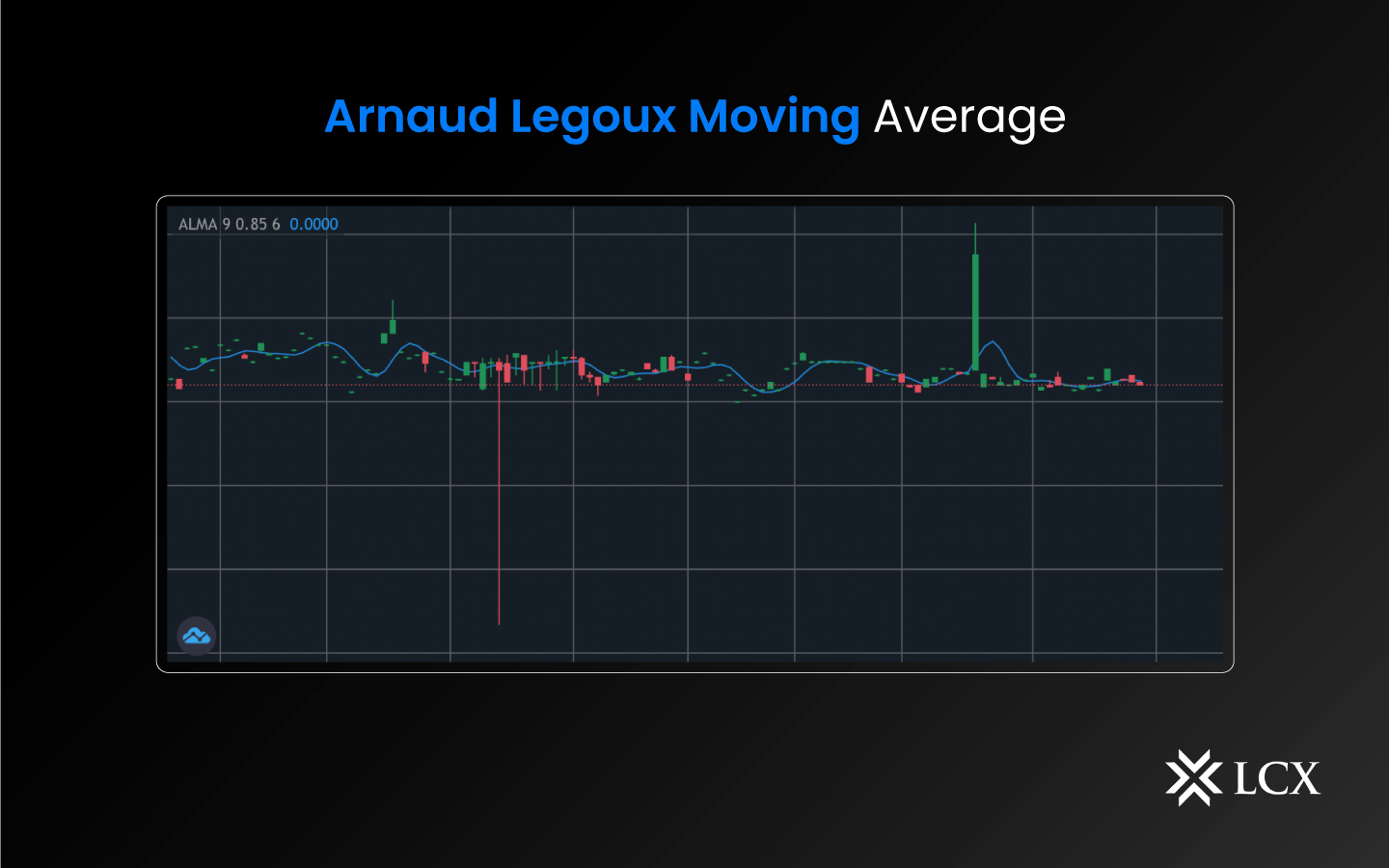

The Arnaud Legoux Moving Average (ALMA) is a technical analysis indicator used by traders to help identify trends and potential buy/sell signals in the crypto market. ALMA was developed by French mathematician Arnaud Legoux and is based on a weighted moving average. This indicator is particularly useful for crypto traders because it can help filter out noise in the market and provide a clearer picture of the overall trend.

ALMA indicator is different from a simple moving average (SMA) in that it places more weight on the most recent price data, which helps to reduce lag and provide a clearer picture of the current market trend. This makes ALMA a more responsive indicator than SMA, which tends to be slower to react to changes in the market.

How does the ALMA indicator work?

ALMA is a weighted moving average that places more weight on the most recent price data. This helps to reduce the lag in the indicator and provides a more accurate representation of the current market trend. ALMA is also unique in that it uses a Gaussian weighting function, which helps filter out market noise and provides a clearer picture of the underlying trend.

The ALMA indicator has two primary parameters that can be adjusted by the trader: the length of the moving average and the offset. The length of the moving average determines the number of periods that will be used to calculate the average. The offset parameter is used to control the weighting function, which in turn affects the responsiveness of the indicator.

How to use ALMA in trading at the LCX exchange?

ALMA can be used in several different ways in crypto trading, including:

-

Identifying trends: Traders can use ALMA to identify bullish or bearish trends in the market. If the ALMA is trending upwards, it may indicate that the market is in a bullish phase, and vice versa.

-

Generating buy/sell signals: Traders can use ALMA to generate buy/sell signals by looking for crossovers between the ALMA and the price action. For example, a buy signal may be generated if the price action crosses above the ALMA, while a sell signal may be generated if the price action crosses below the ALMA.

-

Identifying support and resistance levels: Traders can use ALMA to identify potential support and resistance levels in the market. If the ALMA is trending horizontally, it may indicate a key level of support or resistance.

Conclusion

The Arnaud Legoux Moving Average (ALMA) is a useful technical analysis indicator for crypto traders looking to identify trends, generate buy/sell signals, and identify potential support and resistance levels in the market.

By placing more weight on the most recent price data, ALMA provides a more accurate representation of the current market trend and can help traders make more informed trading decisions.