Trading in the cryptocurrency market can be an incredibly lucrative opportunity, but it’s also one of the most volatile. As a trader, it’s important to be able to identify and capitalize on market trends to maximize your profits. One of the most popular trading strategies for identifying market trends is the use of bear and bull flag patterns.

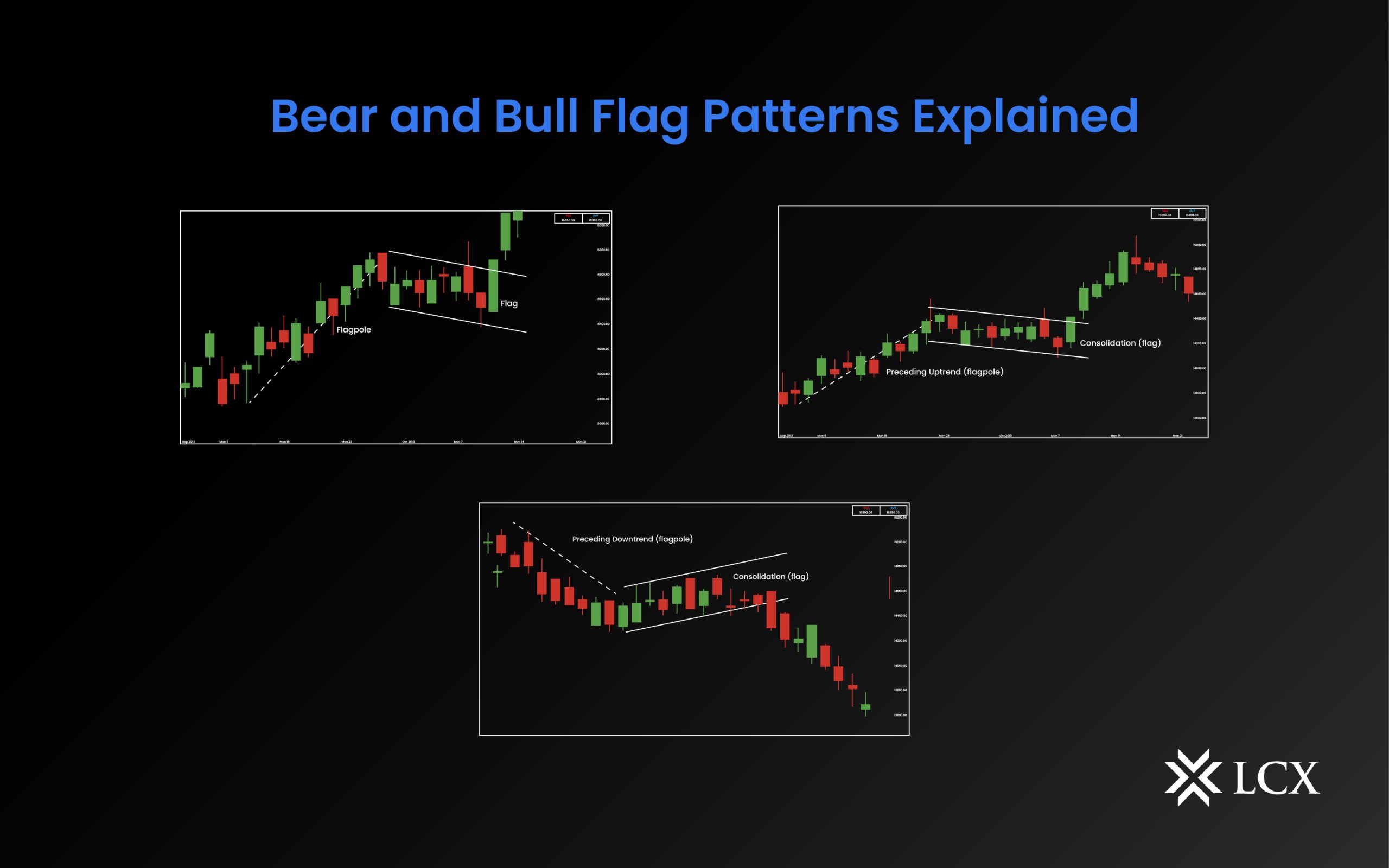

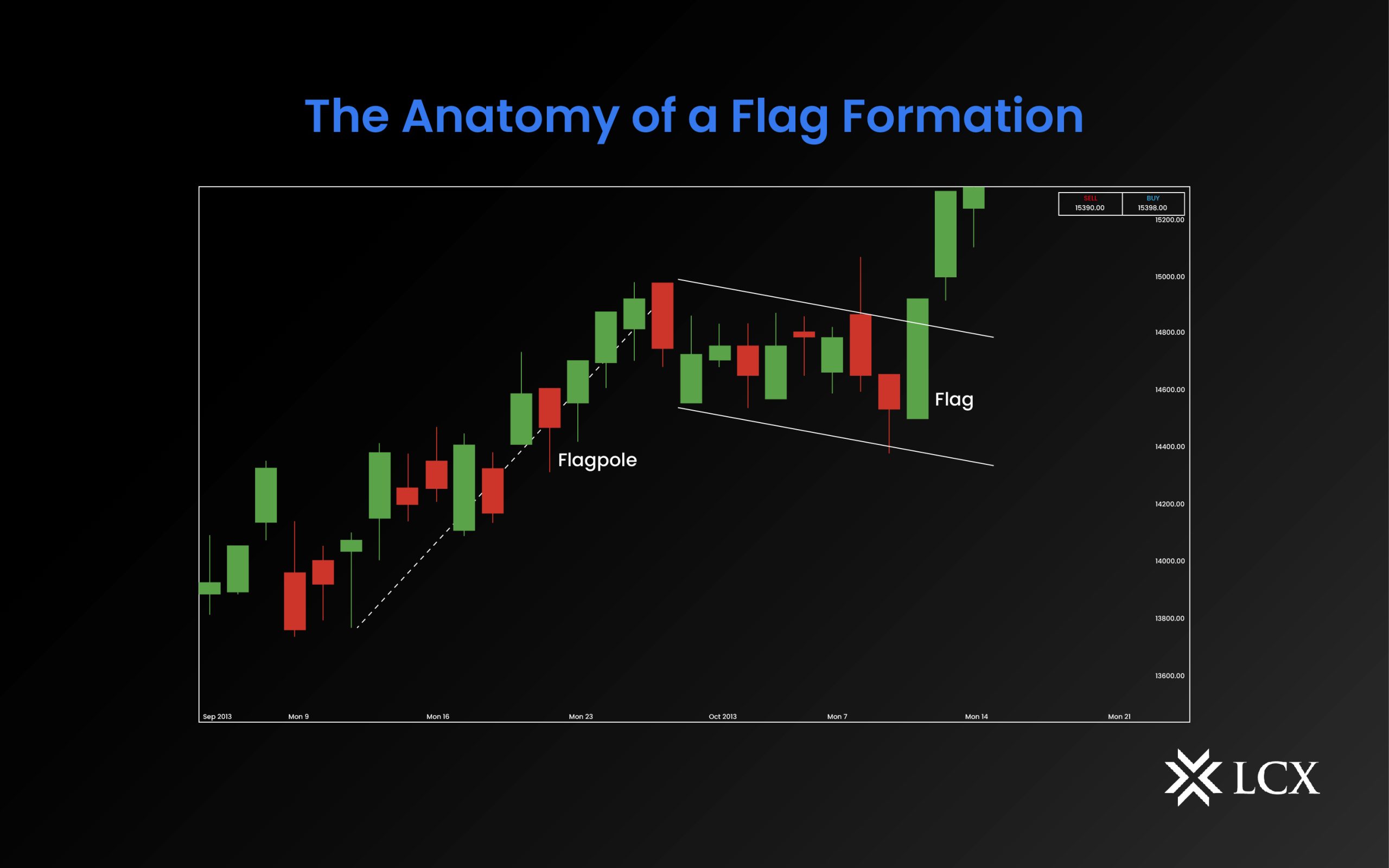

A flag pattern in technical analysis suggests that short-term price movements within a parallelogram correspond to the prior long-term trend. Traditional analysts view flags as potential trend continuation indicators. There are two types of flag patterns: bull flag and bear flag. Bear and bull flag patterns are two of the most common technical chart patterns that traders use to identify potential trend reversals. These patterns are formed when there is a significant price movement in either direction followed by a consolidation period, creating a flag-like shape on a chart.

While their respective outcomes are different, each flag possesses the following five common characteristics: a strong preceding trend (flagpole or pole), a consolidation channel (the flag itself), a trading volume pattern, a breakout, and a confirmation of the price moving in the direction of its previous trend.

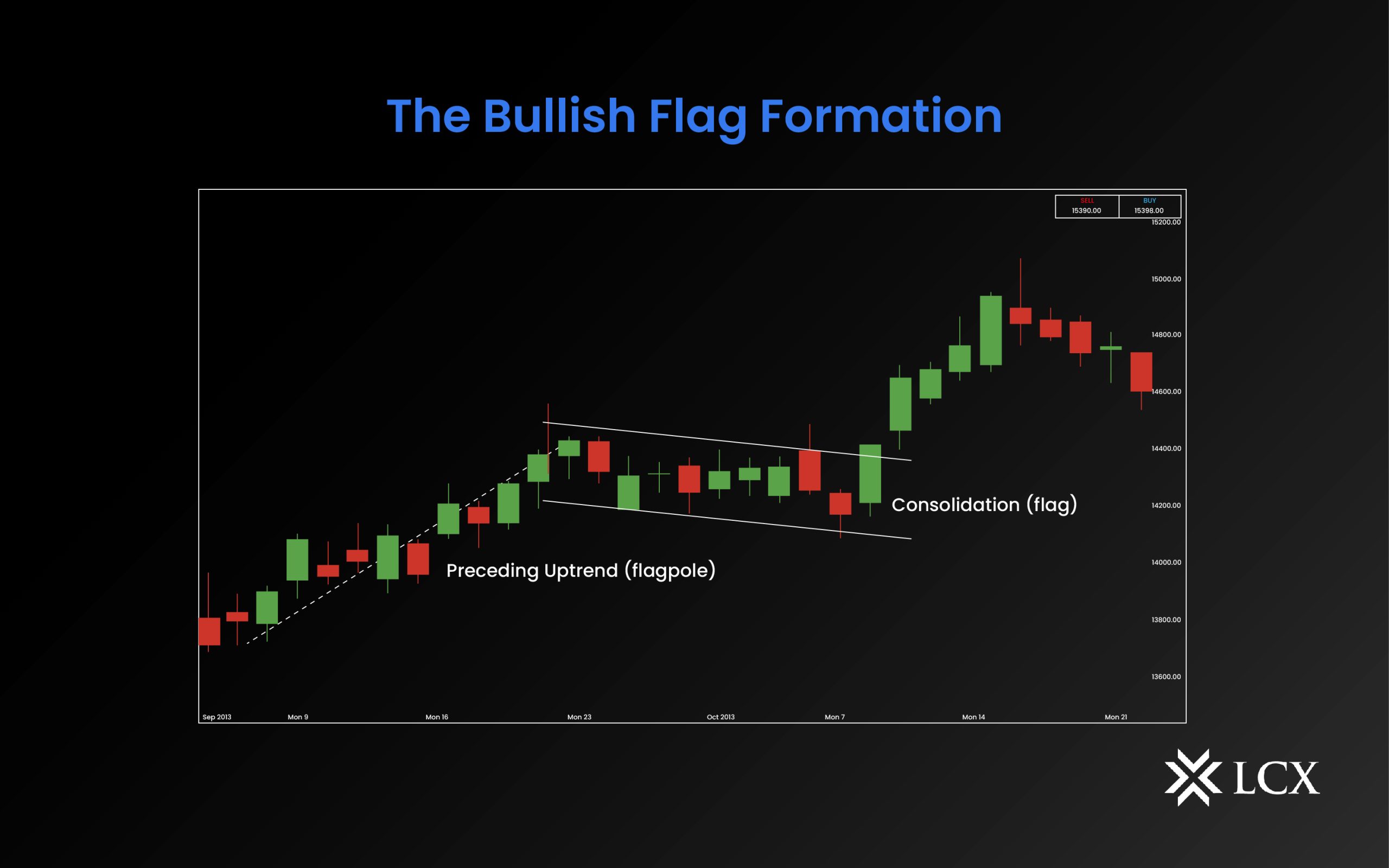

What Is a Bull Flag Pattern?

A bull flag is a technical pattern that forms when the price consolidates lower inside a downward-sloping channel following a strong rally. The aforementioned channel contains two parallel ascending trendlines. The pattern could be a wedge or a pennant if the trend lines converge. During consolidation, volume often decreases, indicating that traders involved with the prior trend are less eager to purchase or sell during the consolidation period. This pattern typically indicates that the market is likely to continue its upward trend. To identify a bull flag pattern, look for the following:

- A strong and steep upward move in the price of the asset.

- A consolidation period with a downward-sloping channel.

- The flag should be relatively symmetrical, with parallel trend lines that slope downward in the opposite direction of the pole.

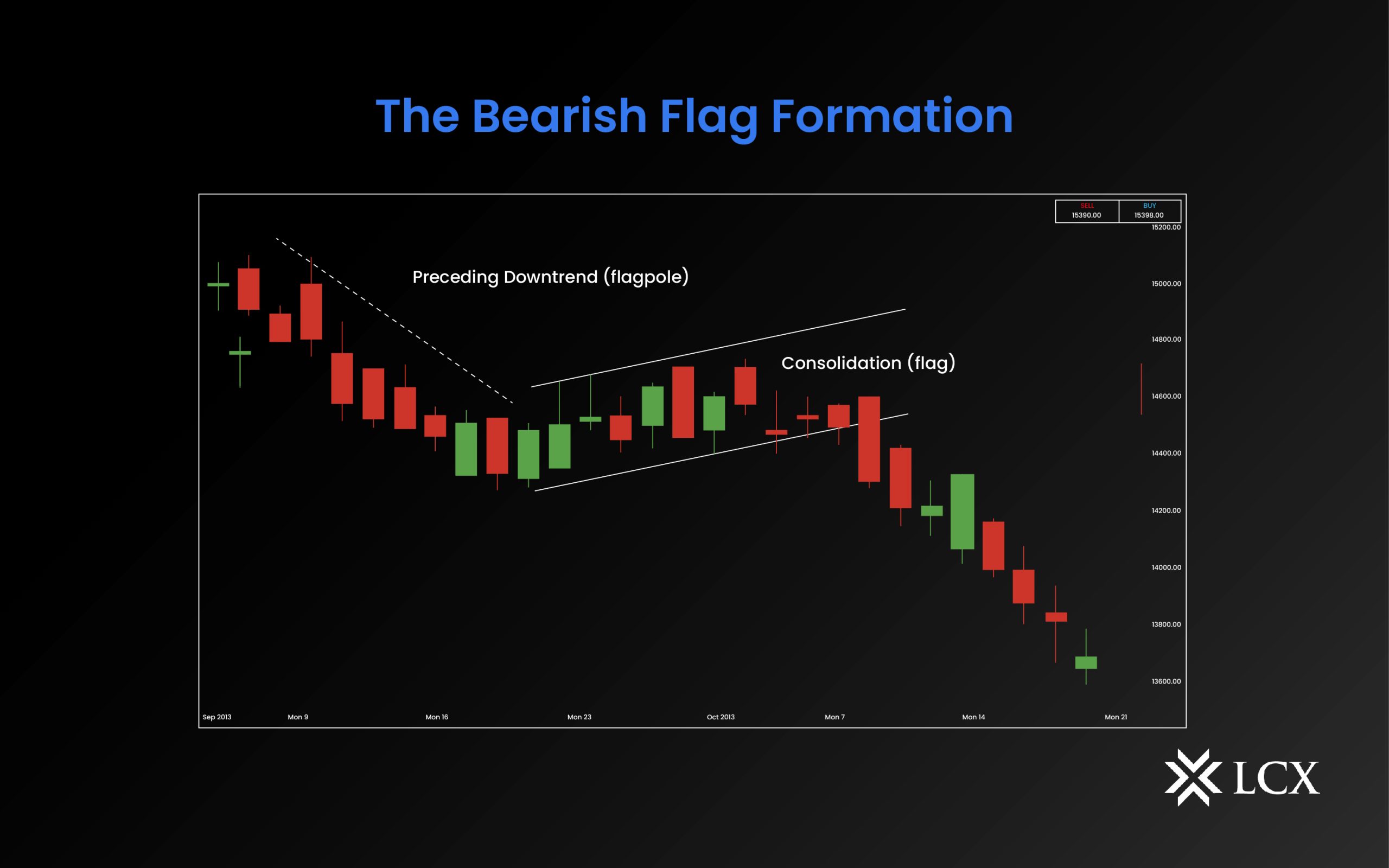

What Is a Bear Flag Pattern?

A bear flag pattern is the inverse of a bull flag pattern, characterized by an initial decline followed by a consolidation higher inside a parallel channel. The downward movement is referred to as the flagpole, while the upward consolidation channel is the actual bear flag. A bear flag is formed when there is a significant price decline followed by a period of consolidation, creating a flag-like shape with a downward-sloping channel. This pattern typically indicates that the market is likely to continue its downward trend. To identify a bear flag pattern, look for the following:

- A strong and steep downward move in the price of the asset.

- A consolidation period with an upward-sloping channel.

- The flag should be relatively symmetrical, with parallel trend lines that slope upward in the opposite direction of the pole.

Trading Bull and Bear Flag Patterns in Crypto

To summarize the patterns in general, they indicate a continuation of the prior trend, with the flag representing a pause or consolidation before the trend resumes.

Here are some tips for trading bull and bear flag patterns in crypto:

- Look for confirmation: Don’t enter a trade until there is a confirmed valid pattern formation. This may include a breakout from the flag pattern or a strong move in the direction of the prior trend.

- Set your stop loss: Always use a stop loss to limit the losses if the trade doesn’t go as planned. It is advisable to place the stop loss just below the bottom of the flag (for a long position) or just above the top of the flag (for a short position).

- Take profits: Consider taking profits at predefined levels, such as resistance or support levels or Fibonacci retracement levels. Investors can also use trailing stops to lock in profits as the trend continues.

- Watch for false breakouts: Sometimes the price may break out of the flag pattern, only to quickly reverse course. Keep an eye on the volume and price action to determine if the breakout is valid or a false signal.

- Consider the broader market: Remember to consider the broader market context when trading flag patterns. A bullish flag pattern in a bearish market may not be as reliable as a bullish flag pattern in a bullish market.

In Conclusion

Trading bear and bull flag patterns can be an effective strategy for identifying potential trend reversals in the cryptocurrency market. By identifying these patterns and using them to form trading strategies, investors can increase their chances of maximizing profits while minimizing potential losses. However, it’s important to remember that no trading strategy is foolproof and that there is always a risk involved when trading in the cryptocurrency market. As such, it’s important to do your own research and exercise caution.