Cryptocurrencies as an investment class is gaining the attention of professional traders, family offices and institutional investors. At a time when the coronavirus pandemic led the global economy to a recession and federal governments around the world are responding with unprecedented stimulus efforts, cryptocurrencies have outperformed stocks, bonds and commodities. Market experts argue that digital assets should now make up a key part of any asset portfolio.

Still trading cryptocurrencies is quite complex. The overall volatility of this market make the process hard even for experienced traders, not to mention newbies. The advanced crypto trading platform LCX Terminal steps forward to facilitate the process with the help of its new Cryptocurrency Smart Order Routing (SOR) service.

Smart Order Routing for Cryptocurrencies is the process of automatically finding the best available price across multiple exchanges to optimize the outcome of trading any pairs.

Key problems of the cryptocurrency trading industry

Invented in 2008 and released to the general public in 2009, Bitcoin has inspired many IT projects to create their own alternative cryptocurrencies or altcoins based on its open-source code. As a result, there are now more than 5,000 cryptocurrencies available for trading according to CoinMarketCap.

Invented in 2008 and released to the general public in 2009, Bitcoin has inspired many IT projects to create their own alternative cryptocurrencies or altcoins based on its open-source code. As a result, there are now more than 5,000 cryptocurrencies available for trading according to CoinMarketCap.

Although Bitcoin was initially created as an alternative peer-to-peer electronic cash system, to stand in place traditional fiat money and payment services, the limits of scalability and level of its volatility prevents it from being adopted at a mass scale. However, the diversity of digital assets serves as a perfectly fertile ground for traders, hedge funds, and professional investors. Compared to traditional stock markets, this market is still pretty young, but it has already revealed a number of serious problems, among which are the following:

- Liquidity fragmentation. Apart from centralized marketplaces, cryptocurrencies can be traded on an ever-increasing number of various trading venues, including decentralized exchanges or relay exchanges. The flip side of this diversity is the liquidity fragmentation when the price and the amount of the same altcoins differs on different platforms.

- Inconsistent cryptocurrency market prices. This abundance of choices also makes it extremely hard to find the best price to trade cryptocurrencies. Even if a trader has verified accounts on a few dozens of exchanges and finds the best offer, the price may easily change while the transaction is being processed. Thus, there’s no guarantee that you get the best deal.

- The lack of liquidity for big orders. It’s near to impossible to convert a big portion of crypto in a single transaction. Cryptocurrency markets just don’t provide sufficient liquidity. To make a switch, one has to either close all the offers from the order book at much worse rates or conduct tons of manual work to outplay local bots and get the best rate.

All these issues reduce the profitability of the whole enterprise and at the same time increase the amount of routine work that traders and asset managers have to accomplish on a daily basis. Institutional investors and hedge funds come across problems with liquidity and cannot use their capitals at full capacity due to technical inefficiencies of centralized exchanges.

A solution is needed to eliminate all these problems, and this is exactly what LCX Cryptocurrency Smart Order Routing service is designed for.

How Crypto Smart Order Router works

Smart Order Routing or shortly SOR is indeed a perfect tool to cope with ever changing prices and liquidity problems. This is an automated tool that helps process orders at the best price available across multiple markets in real time. In order to provide the best offer, it checks the current rate for any selected pair across different exchanges and helps to find the route to make a switch.

Smart Order Routing or shortly SOR is indeed a perfect tool to cope with ever changing prices and liquidity problems. This is an automated tool that helps process orders at the best price available across multiple markets in real time. In order to provide the best offer, it checks the current rate for any selected pair across different exchanges and helps to find the route to make a switch.

The advantages of such an approach are plenty. With the help of SOR, you can:

- Get best-priced trades for digital assets. SOR guarantees that the exchange will be conducted at the best rate across the linked exchanges.

- Execute orders in an automated way. Perhaps, one of the best things about SOR is that it reduces tenfold the amount of routine work that you have to do.

- Access liquidity across linked exchanges. The automated approach also helps you seamlessly switch big amounts of crypto across many exchanges instead of relying on a single market.

- Fast transactions with low latency. SOR has practically no effect on the speed of transactions as orders are executed nearly instantly.

- Tackle liquidity fragmentation and even benefit from it. SOR analyzes the current state of the market and places orders by defined rules and algorithms helping switch assets at the best rate.

- Leverage arbitrage opportunities. The automated technology can help you use the inefficiencies of various markets for your own good and make profits based on regional price differences.

The last benefit can be most interesting for sophisticated traders with solid experience behind their shoulders. Let’s take a closer look and see how Smart Order Routing can help you not only eliminate inefficiencies of the cryptocurrency market but even make them work for you.

Arbitrage Trading in Crypto

Arbitrage is the process of taking advantage of inefficiencies in markets. Initially discovered on traditional stock markets, arbitrage trading makes it possible to use imbalances in prices between various markets for your own profit.

Here’s a real-life example, taking our utility token, to showcase how it works. Let’s say, 10’000 $LCX is offered at Liquid Exchange for 0.41 ETH (approx. 86 USD) and for 0.49 ETH (approx. 101 USD) on IDEX Exchange. There is an arbitrage opportunity of 0.08 ETH (approx. 17 USD). Purchasing a crypto asset in one place and selling it in the other one wouldn’t make you a fortune. However, if you trade these assets in bulks and more often, you can get a very good price. Note: Once you purchased LCX Token you can simply use it to upgrade to a pro account at LCX Terminal.

The same approach is easily applicable to other cryptocurrency assets. The price for the same digital assets can vary significantly across different exchanges. LCX Smart Order helps to automate arbitrage trading across multiple exchanges and saves you tons of time and effort.

For whom LCX Smart Order will be useful

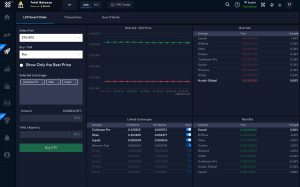

LCX Smart Order is useful for anyone who is exposed to crypto assets. LCX Smart Order helps you deploy real-time trading strategies directly across any combination of markets and exchanges. LCX’s smart order routing system is an easy-to-use platform, integrating industry-leading charting tools and advanced order management features. The following groups of users can particularly benefit from using it in their daily trading activities.

- Cryptocurrency traders. LCX Smart Order helps sophisticated traders to operate more efficiently and improve their performance.

- Institutional traders. LCX offers game-changing features that can help institutional players get some significant advantages and improve the liquidity of the assets they trade.

- Crypto fund managers. LCX offers high-quality and comprehensive trading tools for professional investors, crypto funds and hedge funds.

Sign up to test LCX Smart Order for free

Intelligent Smart Order Router technology works for almost any crypto trading pair and ensures better execution across multiple venues. Sign up for a free account at LCX Smart Order. To make use of the automation benefits provided by the tool, follow the step-by-step instruction given below:

- Sign up on the LCX platform.

- When logged in, access LCX Terminal

- Link exchanges where you want to trade.

- Open the “Smart Order” tab and enjoy the simplicity of your trades’ automation.