LCX had the pleasure of attending the Finance Meets Future conference (September 26, 2018) in Vaduz. The event brought together a diverse gathering of bankers, lawyers, startups and regulators from Liechtenstein and nearby countries.

Once again, we are heartened by Liechtenstein’s unprecedented approach toward cryptoassets. The enthusiasm and engagement from traditional financial institutions is truly remarkable. We’d like to take this time to highlight #FMF2018, as it not only inspires confidence in Liechtenstein’s path toward regulatory clarity, it sets a new tone and style predicated on industry maturity and dialogue with existing financial institutions.

Highlights from #FMF2018:

- H.S.H. Prince Michael of Liechtenstein’s Opening speech touched on the role of crypto in the context of the monetary system and the significance of ICOs as disruptions to global liquidity (i.e. stock markets). Quoting Vitalik as he closed his keynote, The Prince once again demonstrated not only Liechtenstein’s open approach, but an intellectual and sophisticated basis for how cryptoassets fit into a broader history and ecosystem of global finance.

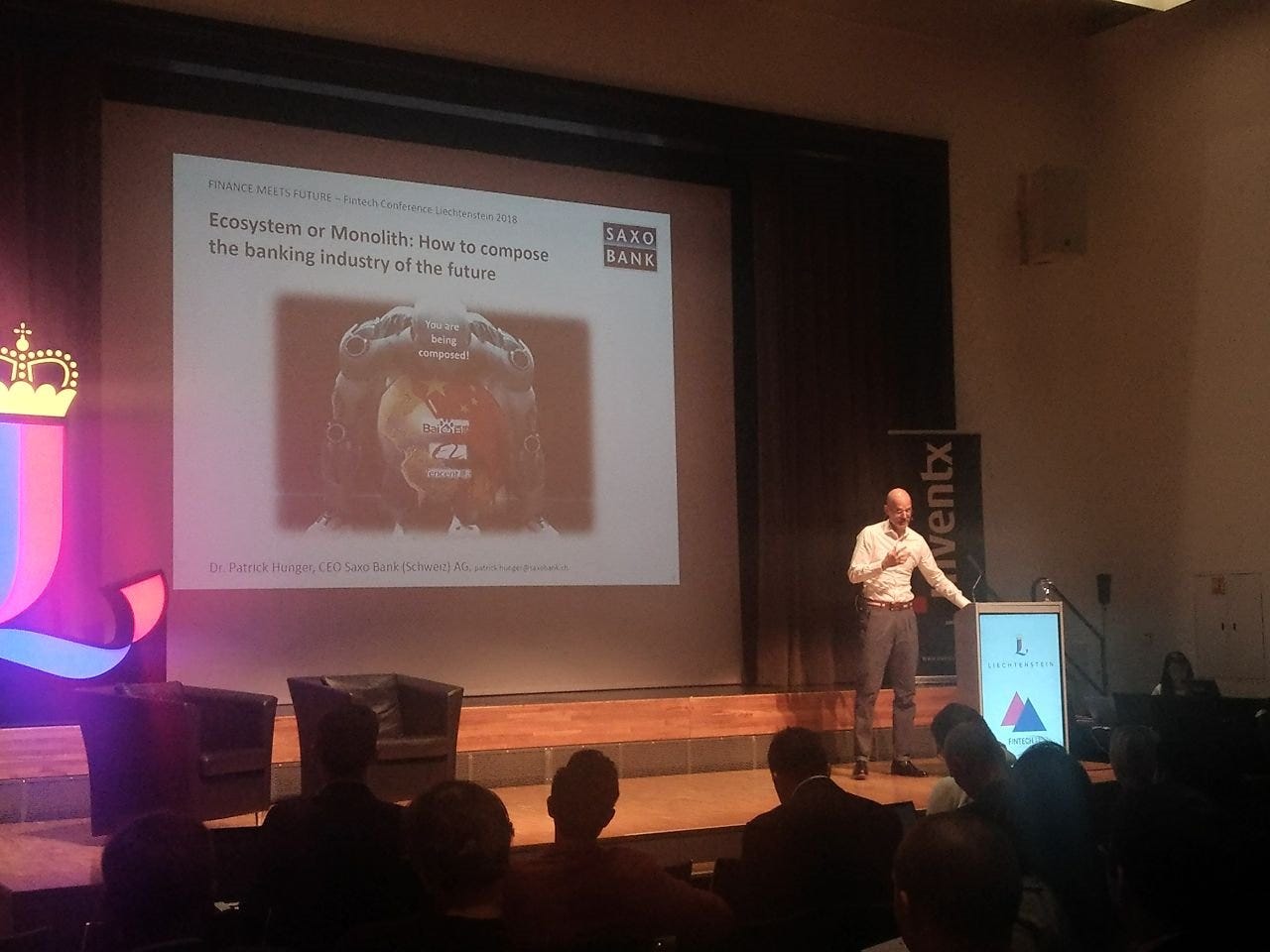

- CEO of Saxobank Patrick Hunter’s speech titled “Ecosystem or Monolith: How to compose the banking industry of the future”. As the CEO of a leading Swiss investment bank on the frontier of European FinTech, Hunter shocked the room of bankers with a startling reminder of the need for proactive rather than reactive financial innovation:

“We need to admit today, that we’re not composing the financial industry, we’re being composed… doing something better or more efficient is solving old world problems. We need to start unlearning.”

- The Liechtenstein Government’s Head of Blockchain Thomas Dünserand local lawyer Thomas Nägeleunpacked Liechtenstein’s Blockchain Law. They touched on a number of aspects of the law, from the issuance of tokens through to the world-first concept of “physical validators”. Nägele’s speech highlighted that the law is not simply a legal framework for cryptoassets and ICOs, but an entire framework to tokenize real world assets and integrate them into the existing financial system.

- Patrick Bont, from the Financial Market Authority (FMA), Liechtenstein’s financial regulator, provided an update titled “FinTech in Liechtenstein — Update from the FMA”.

We were excited to meet representatives from leading banks, funds and financial institutions in Liechtenstein, who continue to not only explore the asset class tentatively, but embrace the imperative of cryptoassets as a cornerstone of financial innovation.