On 13th June, 2022, Monty Metzger CEO and Founder of LCX shared his thoughts, ideas, plans and prospects of Tokenization in METAFORUM conference. He has been working on making everything tokenized for the benefits of the community. Thus, LCX was created as a solution for compliant digital assets and security tokens.

LCX is a secure and compliant platform for buying, selling, transferring, and storing digital currency.

In this conference he covered some major parts related to Tokenization, like:

What is Tokenization?

Tokenization is the process of representing real world assets, a financial asset or other rights digitally on a distributed ledger in form of a token

Benefits of Tokenization

-Enabling Global Trade: Anyone from wherever, regardless of demographic constraints, will be able to purchase the tokenized asset.

– Fast and Cheap Settlement: By introducing tokenization into the ecosystem, high settlement and commission fees may be avoided because the process will be automated utilizing smart contracts.

– Unlocking Illiquid Assets: Illiquid assets can be tokenized and then traded on the issuer’s preferred secondary market.

– Fractional Ownership: Assets can be fractionalized to make them more accessible to small investors. Tokenization allows a broader group of investors to invest directly in digital assets, such as tokenized real estate.

– Automation: Through so-called “smart contracts”, numerous intermediate steps can be carried out automatically via the blockchain.

– Transparency: Transparency is the central feature of the blockchain technology and

contributes to the increase in attractiveness of tokenization as an investment opportunity

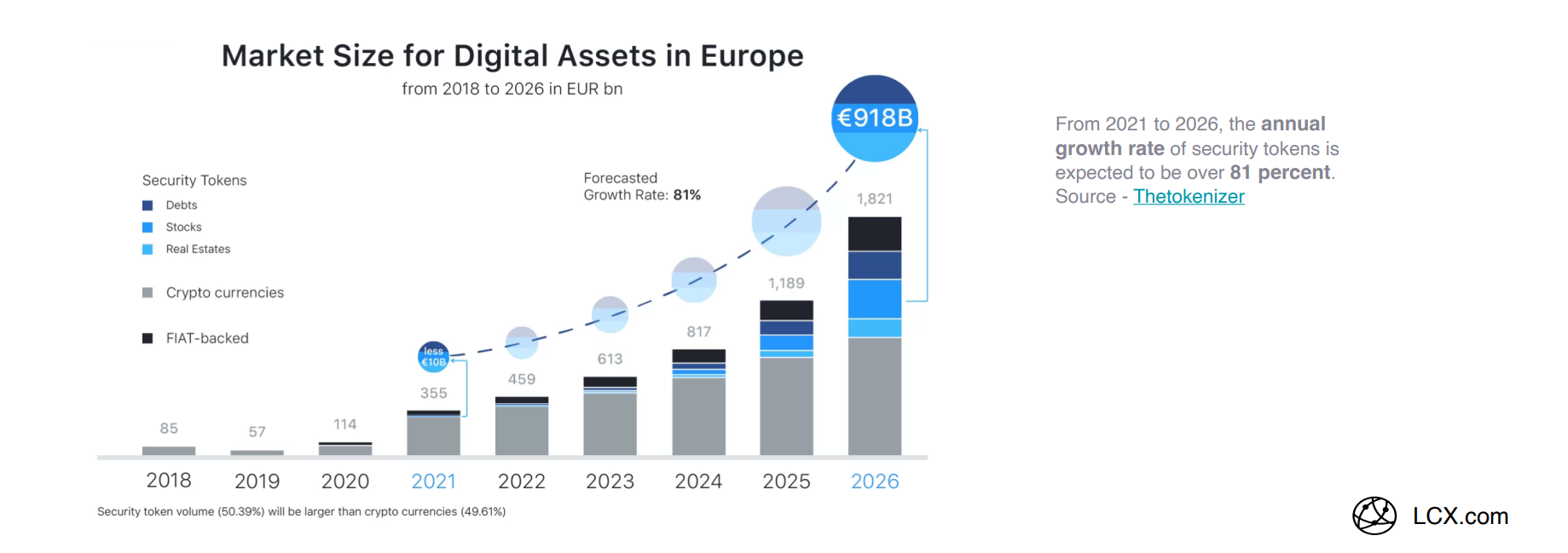

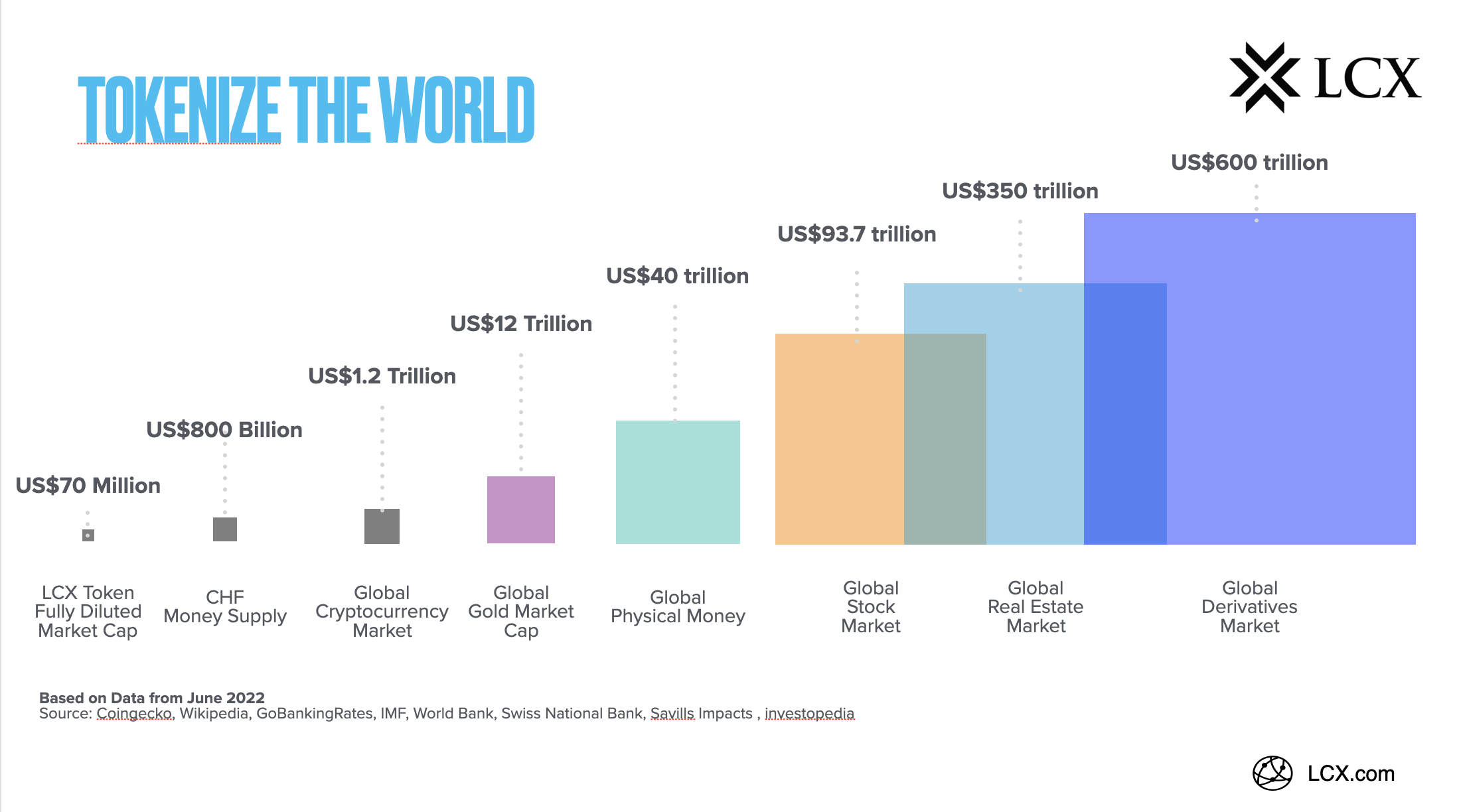

Moving further with the presentation, Monty Metzger shared some statistics that shows where tokenization will reach by 2026.

Increasing data security problems in all data-sensitive companies around the world are driving the tokenization market’s growth. The tokenization market has grown significantly as a result of a large number of financial institutions opting to increase security in payment processing systems. And the following stats speak to the facts.

By 2030, 25% of all securities, publicly listed securities, are going to be tokenized. That’s about 4 trillion USD worth of total issuance volume

You can raise millions in a Token Sale the Legal way through LCX.

LCX is registered as a “Token Issuer” according to Liechtenstein Blockchain Laws.

Fully compliant token issuance solution combining all legal and technology aspects

– Smart contract development

– Token sale legal documents

– Registration at regulator

– Investor on-boarding and KYC

– VIP investor support

– Secret access codes for private token sale

– Community push for public token sale

LCX has conducted successful Token Sale for companies like NFT-MAKER, Digicops labs and Envision Stock this year.

This number shows how companies are getting inclined towards tokenization and planning to launch their own tokens for the benefits of the community.

Not only this but the Tokenization market has reached NFT space and now diamonds can be traded as a part of it.

Tiamonds by LCX is the biggest live example for this.

Tiamonds is the largest blockchain-powered marketplace for diamonds NFTs worldwide.

– Proprietary technology platform launched and developed by LCX. Includes 6 smart contracts enabling trading, vesting and asset tokenization.

– Tiamonds NFTs are non-fungible tokens (NFT) representing the 1-1 ownership rights of real-world Diamonds.

– NFTs are 1-1 assets backed by certified Diamonds.

– Diamonds are certified by the Gemological Institute of America (GIA) and LCX certificates.

– Diamonds are physically stored in a high-security vault in Liechtenstein and are insured by Lloyd’s London.

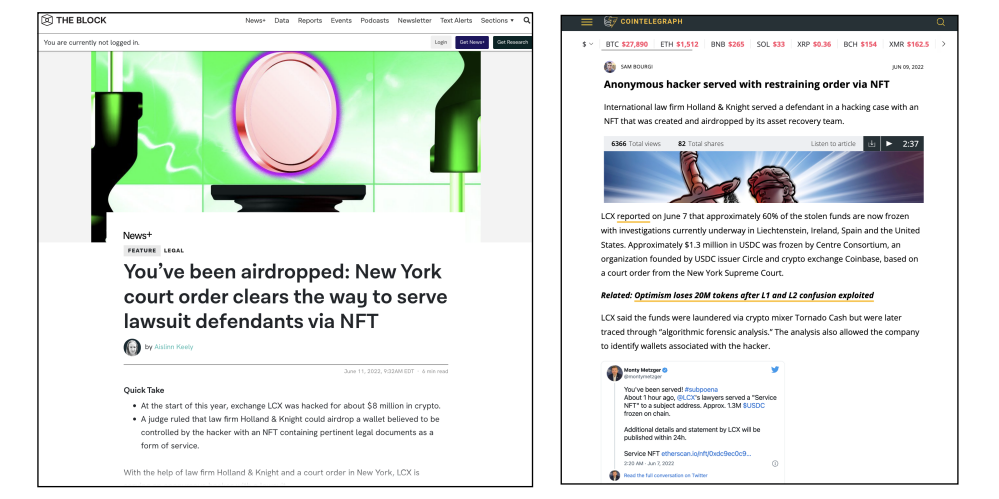

In the starting of the year 2022, LCX suffered from a hack and as a compliant and regulated company we worked to control the theft and make sure that it gets controlled. As a result of it tokenized court order as nft asset recovery of stolen fund; 60% frozen.

LCX achieved a historic milestone by freezing 60% of stolen assets:

– 1.3 Million $USDC had been frozen by Centre Consortium by NY Supreme

Court Order

– 500 ETH had been frozen at Coinbase Europe by Liechtenstein Court Order

The world of tokenization is now getting more accepted due to the increase in cyberattacks and data breaches. Security solutions (like tokenization) are in high demand, even in small and medium-sized businesses (SMEs). The global tokenization market is expected to expand growth during the forecast period, owing to rising demand for market surveillance.

This content is provided for informational purposes only and does not constitute financial, legal, or investment advice. The buying, selling, and trading of cryptocurrencies and digital assets involve significant risk and may result in the loss of your entire investment. Always conduct your research and consult a qualified advisor before making financial decisions. LCX is a regulated entity operating in accordance with the Liechtenstein Blockchain Act. It has approvals for roles including token generator, token issuer, and exchange service provider. LCX provides technology and compliance infrastructure for digital asset services.